Climate Change Levy

Climate Change Levy (“CCL”) is designed to encourage businesses to reduce energy consumption. It applies to supplies of electricity, natural gas supplied by a gas utility, petroleum and hydrocarbon gas in a liquid state and solid fuels.

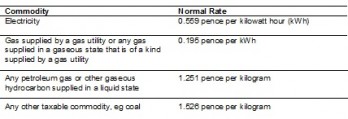

Business users of energy from these sources must pay CCL. The levy is imposed at the time of supply and is included in energy bills. Energy suppliers generally collect the levy which is applied as a specific rate per nominal unit of energy and increases broadly in line with inflation each April. The rates for 2016-17 are as follows:

There are various exemptions and reliefs. Supplies for domestic use or non-business use by charities are excluded from CCL. The domestic and charitable exclusions are based on the VAT fuel and power “qualifying use” provisions.

Domestic use includes use in children’s homes, homes for the elderly and disabled, hospices and residential accommodation for school pupils and university students (as well as houses, flats and other dwellings).

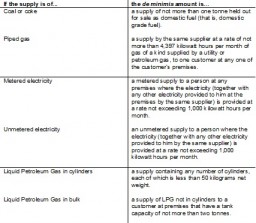

Small (de minimis) quantities of fuel and power can be treated as being for domestic use (even when they are supplied to a business) and are therefore not subject to the levy. The current de minimis levels as set out by HMRC are as follows:

Supplies to charity users for non-business purposes are excluded from CCL. The definition follows that of VAT, so “non-business” activities will include those which are carried out by a charity for no charge (e.g. where costs are covered by grant-funding or donations).

For business activities, the levy is due unless the de minimis limits apply. This will therefore affect activities such as:

- sale of donated goods;

- hiring of charity-run buildings (for example, village halls), and

- provision of membership benefits by clubs, associations and similar bodies.

Where supplies are made to a charity whose premises are put partly to domestic or non-business charity use:

- if this is at least 60 per cent of the total use, the whole supply can be treated as such and is not subject to the levy; or

- if less than 60 per cent of the total use, the levy will need to be applied to that portion that does not qualify for relief.

A supplier of fuel and power for mixed use should obtain a VAT certificate from the charity declaring what percentage is, or will be, put to domestic or charitable non-business use for each of the premises supplied. Relief from CCL will be applied on this basis.

Get email updates on Climate Change Levy

This content is available to our members

If you are a member...

Otherwise please join us and be part of a movement helping to create fair taxation for charities.

Payment is voluntary for charity members.

Joining is easy and benefits include:

- Regular updates on charity tax issues

- Attend exclusive events

- Regular seminars on specific concerns

- Free technical helpline

- Regular meetings with Treasury, HMRC

- Be part of a movement helping to create fair taxation

Latest on Climate Change Levy

- News

- Tax updates

- Consultations

News

No content has been posted here yet.

Tax updates

No content has been posted here yet.

Consultations

No content has been posted here yet.