Key tax developments from April 2021

A helpful detailed list of changes in April 2021 and the start of the new tax year can be found here, including confirmation of various tax rates. Some other highlights are expanded on below.

Digital links requirements for MTD for VAT

The soft landing period for MTD for VAT has now finished digital links are now required from 1 April 2021. This means that ‘cut and paste’ or ‘copy and paste’ is no longer permissible although there are certain manual adjustments that are still permitted. HMRC officials have participated in two sessions with CTG members to answer their questions on digital links requirements that become mandatory for Making Tax Digital for VAT from 1 April 2021. The slides from the meeting with HMRC in January (providing an overview of MTD for VAT) are available here and a recording of the session can be viewed here. The slides from the February meeting (mainly focused on charity questions on “digital links) can be downloaded here and you can view a recording of the session here. You may well find it helpful to review their answers and the practical help that you can find in the VAT Notice. We have asked HMRC to provide written responses to the questions discussed during the meeting and the other questions that were submitted. If you have any other outstanding questions about digital links, please send them to info@charitytaxgroup.org.uk.

Extension to temporary reduced VAT rate for tourism and hospitality

As announced in the Budget the temporary reduced VAT rate of 5% for goods and services supplied by the tourism and hospitality sector was scheduled to come to an end on 31 March 2021. This has now been extended until 30 September 2021, at which point the rate will increase to 12.5% for a further six months until 31 March 2022, before returning to 20%.

National Minimum Wage (NMW) and National Living Wage (NLW)

Both the NMW and NLW have increased from April 1 2021 and, for the first time, the NLW will also be given to 23 and 24-year-olds. The increases mean that:

- National Living Wage (23+) has increased 2.2%, from £8.72 to £8.91

- National Minimum Wage (21-22) has increased 2%, from £8.20 to £8.36

- National Minimum Wage (18-20) has increased 1.7% from £6.45 to £6.56

- National Minimum Wage (under 18) has increased 1.5% from £4.55 to £4.62

- Apprentice Rate has increased 3.6% from £4.15 to £4.30

National Insurance contributions relief for employers who hire veterans

From 1 April, National Insurance contributions relief will be provided for employers who hire veterans. The relief will provide a zero-rate of secondary Class 1 National Insurance contributions on civilian employment after leaving the regular armed forces.

Changes to off-payroll working

From April 2021 the rules for engaging individuals through personal service companies are changing. The responsibility for determining whether the off-payroll working rules (sometimes known as IR35) apply will move to the organisation receiving an individual’s services. Small companies will be exempt which will mean a large number of charities will be excluded. The Companies Act definition will be used – to be small a company must meet two of the following conditions:

- annual turnover must be not more than £10.2 million

- the balance sheet total must be not more than £5.1 million

- the average number of employees must be not more than 50.

In response to consultations on this issue, CTG has argued that the definition of turnover should exclude donation and grant income – HMRC has now confirmed that this is the case. Read more via HMRC guidance notes for changes to off-payroll working for intermediaries and contractors, and for clients. This issue will also be covered in the forthcoming Expert Insight Session on employment taxes.

Statutory redundancy pay calculations

New limits on employment statutory redundancy pay came into force on 6 April 2021. Employers that dismiss employees for redundancy must pay those with two years’ service an amount based on the employee’s weekly pay, length of service and age. The weekly pay is subject to a maximum amount of £544 from 6 April 2021.

Statutory family-related pay and statutory sick pay

The weekly rate of statutory maternity, paternity, adoption, shared parental and parental bereavement pay increases to £151.97 from 4 April 2021. The weekly rate of statutory sick pay increases to £96.35 from 6 April 2021.

Staff working from home

At the start of the new tax year on 6 April, HMRC confirmed the same relaxed rule will apply for the 2021/22 tax year. Employed workers who were forced to work from home because of the pandemic can now claim the government’s working from home allowance for the 2021/22 tax year. This gives workers a £6 per week allowance to cover home working costs and can be applied for at any time after the new tax year started. Those that haven’t claimed their allowance for the 2020/21 tax year can do this at the same time as claiming the current tax year. Claims can be made here.

Covid-19 – testing exemption

The Government has extended the tax and NICs exemption for employer-provided or reimbursed COVID-19 tests until 5 April 2022. The exemption had been due to come to an end on 5 April 2021 but was extended at the Budget on 3 March 2021. It covers employer-provided and employer-reimbursed PCR and lateral flow antigen and RNA tests. Antibody tests are not covered by the exemption.

Business rates holidays extended

- England: The Government announced that it will continue to provide eligible retail, hospitality and leisure properties in England with 100% business rates relief from 1 April 2021 to 30 June 2021. This will be followed by 66% business rates relief for the period from 1 July 2021 to 31 March 2022, capped at £2 million per business for properties that were required to be closed on 5 January 2021, or £105,000 per business for other eligible properties. Guidance has been published for 2021/22 including a worked charity shop example. To recap, No other grant allowances/subsidy control measures are understood to be in place.

- Wales: Extension of the relief on a temporary basis for 2021-22. Guidance can be found here and again charity shops are named as eligible

- Scotland: Retail, hospitality, leisure and aviation businesses will pay no rates during 2021-22.

- Northern Ireland: Extension of the business rates holiday (including for retail, leisure and hospitality) for a further 12 months (from 1 April 2021)

Restart Grants

The Restart Grant scheme supports businesses in reopening safely as COVID-19 restrictions are lifted. Grants are available from 1 April 2021. Eligible businesses in the non-essential retail sector (including charity shops) may be entitled to a one-off cash grant of up to £6,000 from their local council. Eligible businesses in the hospitality, accommodation, leisure, personal care and gym sectors may be entitled to a one-off cash grant of up to £18,000 from their local council. For charities this includes scout huts, village halls, botanical gardens, attractions, zoos, concert halls, museums and galleries. Full details including links to new guidance can be found here. Subsidy allowance restrictions apply, but are significantly reduced as a result of the recent charity sector campaign. These Grants apply to England only.

Income tax rates and allowances from 6 April 2021

For individual taxpayers across the whole of the UK, the personal allowance will increase by £70 from £12,500 to £12,570. The personal allowance will be frozen until April 2026. The below zero rate bands will remain at their 2020/21 level in 2021/22:

- The dividend nil rate band: £2,000.

- The savings nil rate bands: £1,000 for basic rate taxpayers and £500 for higher rate taxpayers.

- The starting rate for savings income: £5,000.

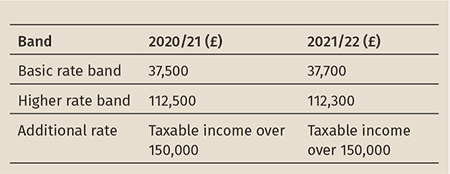

For taxpayers resident in England, Northern Ireland and Wales:

- the basic rate band increases to £37,700, giving a higher rate threshold of £50,270 for 2021/22;

- higher rate tax will apply to taxable income between £37,700 and £150,000 in 2021/22; and

- the additional rate of taxation will apply to income in excess of £150,000.

Taxable non-savings income and savings income in excess of the zero rate bands will remain subject to 20% basic rate tax, 40% higher rate tax and 45% additional rate tax. Dividend income in excess of the nil rate band will remain subject to 7.5% basic rate, 32.5% higher rate and 38.1% additional rate taxation.

The higher rate threshold is frozen at £50,270 until April 2026 (£12,570 + £37,700).

Wales has a devolved power to set income tax rates applying to non-savings, non-dividend income for Welsh tax residents. However, in 2021/22 the income tax rates will remain the same as for taxpayers in England and Northern Ireland.

The table below summarises income tax bands in 2021/22 compared to 2020/21. The table summarises the personal allowance and the basic rate, higher rate and additional rate tax bands that apply to income received by UK resident taxpayers, with the exception of non-savings, non-dividend income received by Scottish resident taxpayers, to which different income tax bands apply (see below).

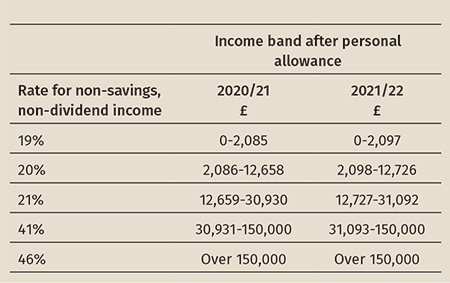

For taxpayers resident in Scotland

Different rates and thresholds apply to non-savings, non-dividend income for Scottish resident taxpayers. The 2021/22 tax rates remain unchanged compared to 2020/21.

The 2021/22 bands in comparison to 2020/21 and applicable tax rates are:

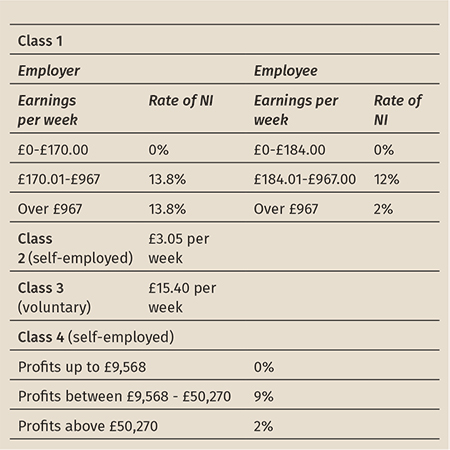

NICs

NICs limits will also rise with the CPI with effect from 6 April 2021. The primary threshold for employees (above which NICs are payable at 12%) increases from £9,500 per annum to £9,568 and the upper earnings limit (above which the NIC rate is 2%) rises from £50,000 to £50,270 in line with the higher rate threshold. As the upper limits for NICs are linked to the income tax higher rate threshold, these are frozen at £50,270 until April 2026. The amount of all other NIC thresholds will be considered in future fiscal events. The table below summarises NIC rates for 2021/22.