Job Retention Scheme: Claims periods and addressing errors in claims

*Update*: The Job Retention Scheme will close on 31 October 2020. Charities may wish to familiarize themselves with the Job Retention Bonus, and the Job Support Scheme.

HMRC has added information to its guidance on defining the claim period for the Job Retention Scheme. Information has also been added about amending claims and what to do if too much is claimed from the scheme.

CTG’s Coronavirus Job Retention Scheme Hub has been updated to reflect these changes and includes links to all the relevant HMRC guidance needed to process a claim and manage records.

Deciding the length of your claim period

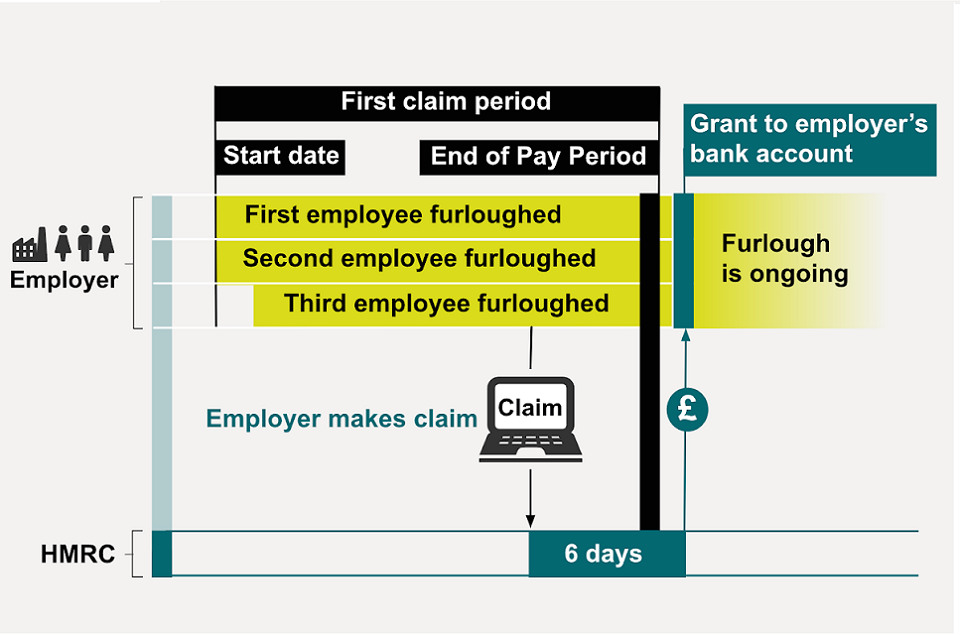

The start date of your first claim period is the date your first employee was furloughed. You can backdate your claim to 1 March 2020 where employees have already been furloughed from that date.

You can make your claim up to 14 days before your claim period end date. You can choose to match your claim period to the dates you run your payroll. Any claim period must contain all of the furloughed days that the claim relates to.

You must include all employees in one claim, even if they’re paid at different times. You cannot make 2 claims for the same period of time.

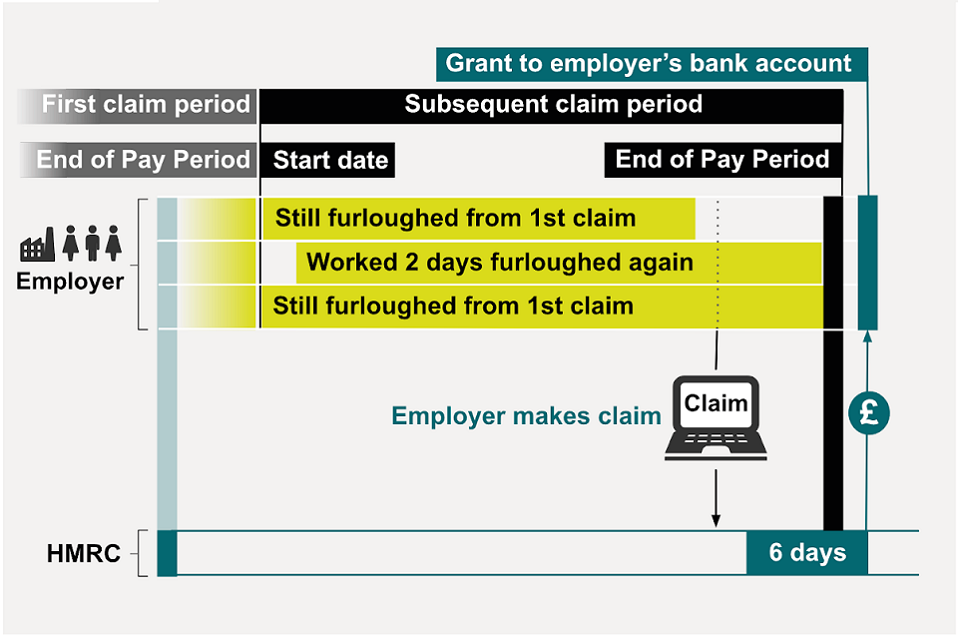

If you claim again, your subsequent claim cannot overlap with your first claim. Where employees have been furloughed continuously, the claim periods must follow on from each other with no gaps in between the dates.

You can claim before, during or after you run your payroll and do not have to wait until the end of a claim period to make your next claim. But it must not overlap with the previous claim period.

Payments will be made 6 working days after you make your claim.

If you make an error when claiming

If you have made an error in a claim that has resulted in an over-claimed amount, you must pay this back to HMRC.

You can now tell us about an over-claimed amount as part of your next claim. You will be asked when making your claim whether you need to adjust the amount down to take account of a previous error. Your new claim amount will be reduced to reflect this. You don’t need to take further action, but should keep a record of this adjustment for six years.

If you have made an error in a claim and do not plan to submit further claims, we are working on a process that will allow you to let us know about your error and pay back any amounts that you have over-claimed. We will update guidance when this is available.