Charity Tax Group Budget 2020 Submission

The Charity Tax Group (CTG) has published a letter sent to the Chancellor, outlining representations on a range of tax issues, in advance of Budget 2020. The Chancellor will publish the Budget on 11 March 2020.

CTG’s overall aim is to seek improvements to the tax system that would result in a simpler and fairer tax system for charities and it is glad to support Government steps that move in this direction.

In the submission, CTG calls on the Government to:

- Commit to a strategic review of the future VAT system with the aim of reducing the irrecoverable VAT charities currently incur

- Confirm that digital advertising by charities is eligible for a VAT zero rate within the current law

- Extend VAT zero rating to electronic publications produced and purchased by charities

- Prioritise resolution of discussions between HMRC and Facebook approving Gift Aid claims on donations received by Facebook (and other fundraising platforms)

- Increase the non-primary purpose trading limit (miscellaneous income) from £80k

- Confirm that the forthcoming review of business rates in England will protect existing charitable reliefs

- Consider tax credits to stimulate the funding of bio-medical research by charities, similar to those provided to investor owned research companies

- Commit to no further increases in Insurance Premium Tax (IPT) for charities and consider targeted relief where the insurance is required for activities or premises directly related to a charity’s objects

- Allow Apprenticeship Levy funds to be used towards the costs of training volunteers.

Charity Tax Group Budget submission 2020

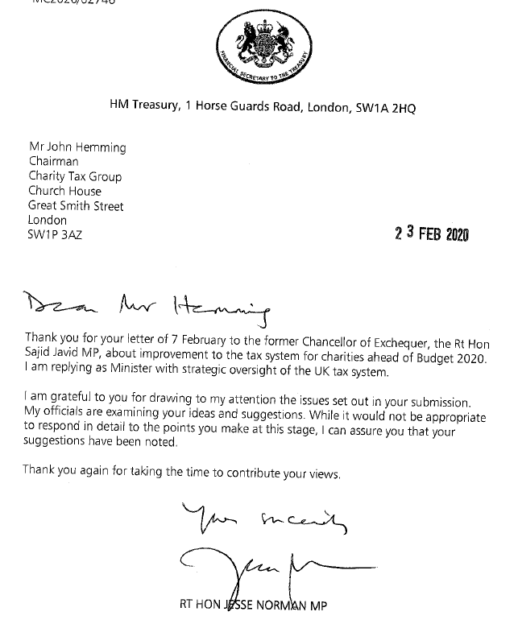

On 23 February a positive response was received from Jesse Norman MP, the Financial Secretary to the Treasury.