Review of the last decade – CTG secures important improvements to the tax system for charities

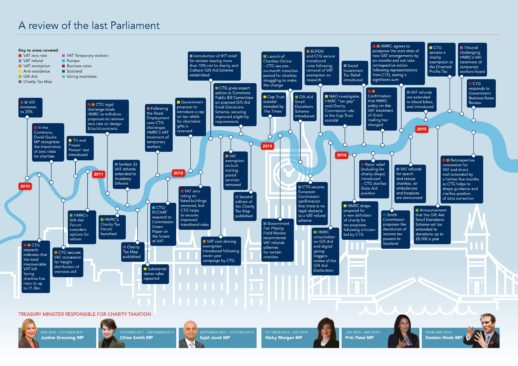

As the end of the decade approaches, CTG reflects on the considerable impact it made in the last ten years, against a backdrop of austerity, Brexit, devolution and a Merry-Go-Round of charity tax ministers.

Highlights include the development of the first Charity Tax Map that laid the foundations for our extensive online charity “taxopedia”. CTG has played a leading role in lobbying Government, helping to shape and improve Gift Aid and the Gift Aid Small Donations Scheme and challenging a proposal to introduce a cap on tax reliefs for charitable gifts. CTG has played an active role in protecting valuable business rate and VAT reliefs (including on design and build contracts) during an extended period of austerity, while also successfully creating a precedent for VAT refunds for charities.

During this period, CTG’s total running costs have been approximately £2m – a fraction of the savings secured for charities and great value for money given the return on investment for the sector.

2010

- In June, research by CTG indicates that the total irrecoverable VAT bill facing charities has risen to over £1bn. This figure is extensively reported

- In the Commons, David Gauke MP, Exchequer Secretary to the Treasury, recognises the importance of the UK’s zero rates to charities and confirms that the Government will protect them

- In the House of Lords, Baroness Morgan of Drefelin, on behalf of the Opposition, quotes CTG’s research on the impact of VAT on charities

- CTG heavily involved in successful campaign to ensure that pay-per-click advertising qualifies for zero-rating

- Following changes to the place of supply rules, CTG leads successful campaign and secures an important concession for charities on freight transportation outside of the EU, potentially saving charities millions of pounds worth of irrecoverable VAT

- CTG secures additional concessions to the Community Infrastructure Levy regulations to ensure that the charity exemption is fully workable

2011

- CTG persuades HMRC to reverse its proposal to withdraw the zero rate applying to the design element of composite design and build contracts – saving the sector more than £200m

- With funding from the Nuffield Foundation, CTG publishes the Charity Tax Map, the first-ever comprehensive study of the impact of taxation on charities

- The substantial donor to charity rules are repealed. CTG was not only involved at the heart of the campaign for their repeal, but worked closely with HMRC to conceive and write the replacement legislation

- After a seven-year CTG campaign, the Government agrees to implement a mandatory EU law provision for a cost-sharing VAT exemption

- In May, CTG/ECCVAT responds to the European Commission’s consultation on the Green Paper on the future of VAT

- European Commission publishes its response to the consultation and calls on Member States to introduce VAT refund schemes on a consistent basis for public bodies and to extend this to charities providing equivalent public good on an outsourced basis

- The House of Commons Public Administration Select Committee (PASC) recommends that the Government extend eligibility for the VAT refund scheme to charities that deliver public services

- John Hemming (Wellcome Trust) elected Chairman

2012

- CTG publishes its Briefing Note – Grants and Contracts. Outsourcing by public sector bodies: VAT implications for charities

- Government proposal to introduce a cap on tax reliefs for charitable gifts is reversed

- VAT zero rating on listed buildings removed, but CTG helps to secure improved transitional rules

- CTG helps to mitigate the impact on charities of VAT being imposed on Royal Mail bulk mailings, for example by proposing alternative arrangements such as Downstream Access (DSA)

- CTG is working with others in support of the introduction of Living Legacies

- Finance Bill 2012 published on 29 March contains measures following consultation with CTG, including:

- cost sharing provisions – many of the CTG’s suggestions were accepted by HMRC

- the reduction in the rate of Inheritance Tax for estates leaving more than 10% net to charity

- the Cultural Gifts Scheme

- CTG gives expert advice to Commons Public Bill Committee on planned Gift Aid Small Donations Scheme (GASDS), securing improved eligibility requirements

2013

- Government Fair Playing Field Review recommends VAT refunds schemes for certain charities

- Launch of Charities Online – CTG secures six-month transition period for charities struggling to make the change

- CTG secures European Commission confirmation that there is no legal obstacle to a VAT refund scheme

- BUFDG and CTG secure transitional rules following removal of VAT exemption on research

- CTG secures clarification from HMRC officials on the VAT treatment of funding by DfID and similar bodies.

2014

- HMRC drops proposal for a new definition of charity for tax purposes following criticism led by CTG

- Retail relief (including for charity shops) introduced – CTG clarifies State Aid position

- VAT refunds for search and rescue charities, air ambulances and hospices are announced (under s33A of the VAT Act 1994)

- Confirmation that HMRC policy on the VAT treatment of direct mailing has changed – HMRC agrees to postpone the start date of new VAT arrangements by six months and not take retrospective action following representations from CTG, saving the charity sector a significant sum

2015

- VAT refunds for search and rescue charities, air ambulances and hospices are introduced, and are extended to include blood bikes

- CTG obtains charity exemptions from the Diverted Profits Tax and the close company loans to participators rules, having identified that charities would be caught inadvertently by the legislation. Both exemptions save the sector a potential bill of millions of pounds

- Retrospective concession for VAT and direct mail extended by a further five months as CTG helps to shape guidance and clarifies position of data correction

- Working with HMRC, CTG plays a key role in securing important simplifications to the Gift Aid Declaration, including the removal of unnecessary references to council tax and VAT

- Secured Ministerial confirmation that mandatory business rates relief (worth over £1.5bn in England) would be protected as part of the Government’s Business Rates Retention scheme

- Formation of the Gift Aid Working Group enabling charity staff to discuss topical Gift Aid issues and promote best practice

- CTG works with charity shop representatives and HMRC to rewrite and simplify the Retail Gift Aid guidance

2016

- Created the Charity Tax Map on the newly-launched CTG website, providing extensive charity tax resources that allows users to search by tax type and activity

- Secured an increase in the level of eligible donations for the Gift Aid Small Donations Scheme

- Briefed officials on the ongoing value, importance and relevance of retaining the exemption for charity employees regarding employer-provided living accommodation

- Secured an agreement to simplify the connected charities rules (relating to the Apprenticeship Levy), ensuring that connected charities can share their Levy allowance

- Worked with HMRC to update the guidance on VAT treatment of grants, contracts and sponsorship

- CTG continued to work with HM Treasury to consider the implications for Gift Aid of further devolution of tax powers to Scotland.

- CTG highlighted to HMRC officials that the new Common Reporting Standard reporting requirements would have significant adverse implications for the sector and was able to secure an exemption for charitable companies and a more proportionate system for charitable trusts.

2017

- CTG works with HMRC to introduce new Gift Aid donor education materials for online fundraising platforms and charities

- Following consultation with members and meeting with the Office of Tax Simplification, CTG responds to their review of VAT, highlighting practical and structural reforms

- Engaged with HMRC guidance on the VAT treatment of grants and contracts

- CTG expressed concern at proposals to replace the Community Infrastructure Levy (CIL) with a new tariff that would have had “no or few” exemptions for charities. Following action by CTG, the Government proposed retaining CIL and promised that any supplementary tariffs will have protections for charities

- CTG raises concerns with HMRC about an apparent change in the VAT treatment of social media advertising

- CTG is consulted by HMRC on the planned introduction of Making Tax Digital from 2017. CTG highlighted a number of practical implications for charities that resulted in positive changes to the guidance

- CTG’s Gift Aid working group secured confirmation from HMRC that enduring declarations would be protected and clarified the implications of GDPR in respect of Gift Aid processing. Working group members also secured important clarification on the possibility of claiming Gift Aid on “gone-away” donors.

2018

- CTG provided extensive commentary on the updated HMRC guidance on grants and contracts. This guidance is the most read on the CTG website.

- Following representations at CTG’s Annual Tax Conference in 2018, the Government announced important changes to the Gift Aid Small Donations Scheme (extension to contactless payments), Retail Gift Aid Scheme (introduction of a de minimis limit for annual donor letters), Gift Aid donor benefit rules (simplification of the relevant value test) and small trading exemption threshold (increased from £50,000 to £80,000) in the Budget. These changes were implemented in Finance Bill 2019.

- CTG played a leading advisory role to the Charity Tax Commission and submitted a detailed response to its consultation on the future of the tax system

- Following discussions at the Gift Aid working group CTG persuaded the Minister responsible for charity taxation not to impose a blanket ban on Gift Aid fees charged by intermediaries, such as JustGiving.

- CTG led negotiations with HMRC challenging the VAT treatment of online charity advertising consulting charities and taking expert counsel’s opinion.

- CTG held discussions with HMRC on the potential implementation of a reduced VAT rate for e-publications after the European Council ruled this was permissible.

You can read a detailed summary of our work in 2018 here.

2019

- CTG launched an important research survey designed to quantify the value of VAT reliefs to the sector. This was highlighted as an important study by the Charity Tax Commission, in its report, published in the summer of 2019.

- Following discussions with HMRC, a new section in the Making Tax Digital VAT guidance was introduced on charity fundraising events, relaxing the digital record keeping requirements. CTG also published a dedicated “mythbuster” for charities

- CTG launched a future of Gift Aid working group tasked with ensuring Gift Aid could be future proofed and maximised on modern digital payment mechanisms

- The Gift Aid working group persuaded HMRC to drop the idea of collecting mandatory full forenames on Gift Aid declarations

- CTG welcomed the publication of updated sponsorship VAT guidance but called for further changes to this and guidance on grants and contracts

- Recognising that there was a lack of communication between HMRC and Facebook on Gift Aid donations through the platform, CTG mobilised charities and helped to facilitate a meeting to resolve this issue early in 2020

- CTG provided a detailed response to the HMRC consultation on VAT Partial Exemption and the Capital Goods Scheme. This will hopefully lead to helpful simplifications in the future.

- CTG responded to a call for evidence on the Scottish Non-Domestic Rates Bill highlighting concerns that removal of rates relief for mainstream independent schools in Scotland risks the creation of a two-tier status for charities with tax reliefs applicable only to the most “deserving charities”.

You can read a detailed summary of our work in 2019 here.