Making Tax Digital – make sure that your charity is ready

You may have heard that all charities subject to Making Tax Digital (MTD) need to be registered for MTD by 1 October 2019. This is not true, but your preparations should be well advanced.

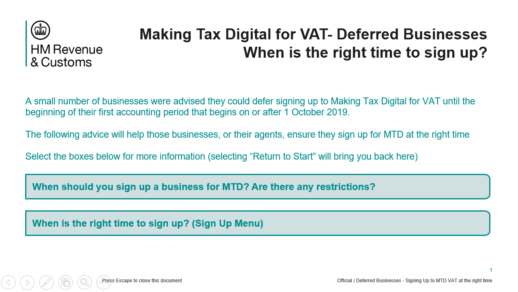

Charities that had their start date deferred are required to join MTD and submit their VAT returns using the new service for their first VAT period which begins on or after 1 October. For the majority, who file quarterly, their first MTD returns won’t be due until 7 February 2020. But remember – charities will need to have signed up to the service, begun keeping their records digitally (which means no manually written records) and set up their MTD compliant software to send information to MTD, in good time before they file their first return under MTD. Businesses that pay by Direct Debit must sign up at least 15 working days before they need to submit to allow the payment to be taken. Once your charity is signed up to MTD, your returns MUST be submitted using MTD compatible software, so do not sign up until you are ready and have the correct systems in place!

Following representations by CTG, HMRC has published an updated sign-up timeline for organisations (including charities) that had their MTD mandated start date deferred until October 2019 – Deferred sign up timelines – v1.0

HMRC will not automatically sign charities up for MTD. Merely having digital software that the provider tells you can submit via MTD does not automatically enrol you for MTD. You need to sign up yourselves. Charities can sign up to MTD VAT here and agents can sign up their charity clients to MTD VAT here.

While there is a one-year soft landing period for ensuring digital links exist between VAT records, MTD for VAT requires charities to keep records in digital form and file their VAT Returns using software. Under MTD the combinations of digitally linked software and packages which business use must be able to keep and maintain the records specified in the regulations, preparing their VAT Returns using the information maintained in those digital records and communicating with HMRC digitally via its Application Programming Interface (API) platform. The soft landing does not mean that charities do not have to do anything until a year after their start date. Digital record keeping and digital filing requirements are mandatory from the start. This includes recording the rate of tax charged and the tax point when the digital record is created which may be new for many charities.

Remember – HMRC has published VAT Notice 700/22: Making Tax Digital for VAT, which provides full guidance on how MTD will work in practice. HMRC has published a stakeholder communications pack including FAQs on MTD for VAT. You can also access HMRC webinars here. HMRC has also published YouTube videos including How to sign up to MTD and Digital record-keeping for VAT. The Charity Tax Group website also includes a wide range of resources for charities and links to useful HMRC guidance and software options. Charities can register for CTG’s regular newsletter here to keep track of developments. Charities that use mainstream accounting software will probably be offered guides and webinars by their providers.