Extension of Making Tax Digital “soft landing” period where implementing digital links in time is unachievable

To help businesses meet their digital link requirements HMRC has allowed a 1-year soft-landing period from their original mandation date (VAT period starting on or after 1 April 2019 or 1 October 2019 for deferred businesses).

Through HMRC’s engagement with stakeholders including the Charity Tax Group they are aware that some businesses (including charities), with complex or legacy IT systems, may require a longer period to put digital links in place across their MTD software to meet their legal MTD for VAT requirements.

Today HMRC opened the process for businesses to apply for additional time, if needed, to put digital links in place in order to comply with the requirements of MTD. This additional time will be provided for businesses with complex or legacy IT systems, who are unable to comply with MTD digital links requirements by the end of the initial soft-landing period.

The criteria for making an application and how to apply are set out in the VAT Notice 700/22, section 4.2.1.3 and reproduced in full below. Applications must be received by HMRC by the end of a business’ soft-landing period and charities would have to actively contact HMRC to benefit from this extension. Charities should note that they must explain why it is unachievable and not reasonable to have digital links in place by the MTD VAT digital links mandation date, for example, why does commercially available software not meet the digital link requirement for your business? Lack of preparedness or simply cost concerns will not be sufficient.

In an email confirming the changes, HMRC has thanked the Charity Tax Group for its contribution to the discussions over the summer on the MTD requirements for digital links, noting that our input was much valued and has helped inform their thinking. CTG has produced a range of MTD resources including a mythbuster and timeline for deferred charities.

While most charities should hopefully be able to meet the digital link requirements with sufficient preparation, this extension does provide welcome reassurance that there is a safety net where changes are unachieveable. It is important that charities start to look ahead and continue to share any concerns about MTD with groups like CTG so that these can be conveyed to HMRC.

When we met HMRC we explained that while charities may be able to get say 95% of digital links in place there will be some difficult cases that may need more time or exemption from the digital links requirements. We questioned whether there may be a tolerance for a small number of non-digital links to avoid a rush of charities seeking an extension under the specific direction. HMRC has noted these concners and specific potential issues relating to volunteers and we expect further engagement on this point going forward.

CTG has also stressed that while extending the soft landing may be helpful in some cases, a greater help would be clarification/education over what a digital link actually means and how this will work in practice. Again, this is something that CTG will continue to work with HMRC on to secure practical support for members,

4.2.1.3 Digital links deadline extensions

For VAT periods starting on or after 1 April 2020 (or 1 October 2020 for deferred businesses) your systems must use digital links for any transfer or exchange of data between software programs, products or applications used as functional compatible software, as stipulated in legislation.

Businesses with complex or legacy IT systems may require a longer period to put digital links in place across their functional compatible software. These businesses can apply for additional time to put the required digital links in place (subject to qualifying criteria). If your business qualifies then the additional time will be granted as a specific direction.

If you acquire another business (for example, your business purchases another company) it may take additional time to digitally link different software applications or packages to meet MTD legal obligations. HMRC will consider specific direction applications outside of the soft landing period(s) where more time is needed to comply with digital link requirements following the purchase of another business.

The cost alone is not sufficient reason to issue a specific direction. Business are expected to make every effort to comply with the digital links requirements by the end of the soft landing period.

Further details regarding digital links can be found at section 4.2.1.

Criteria

To be considered for a specific direction, you will need to:

- make a formal application to HMRC as soon as possible for an extension and by no later than the end of your soft landing period

- explain why it is unachievable and not reasonable for you to have digital links in place by the MTD VAT digital links mandation date (in April 2020 or October 2020, for businesses mandated to join MTD in 2019) for example, why does commercially available software not meet the digital link requirement for your business?

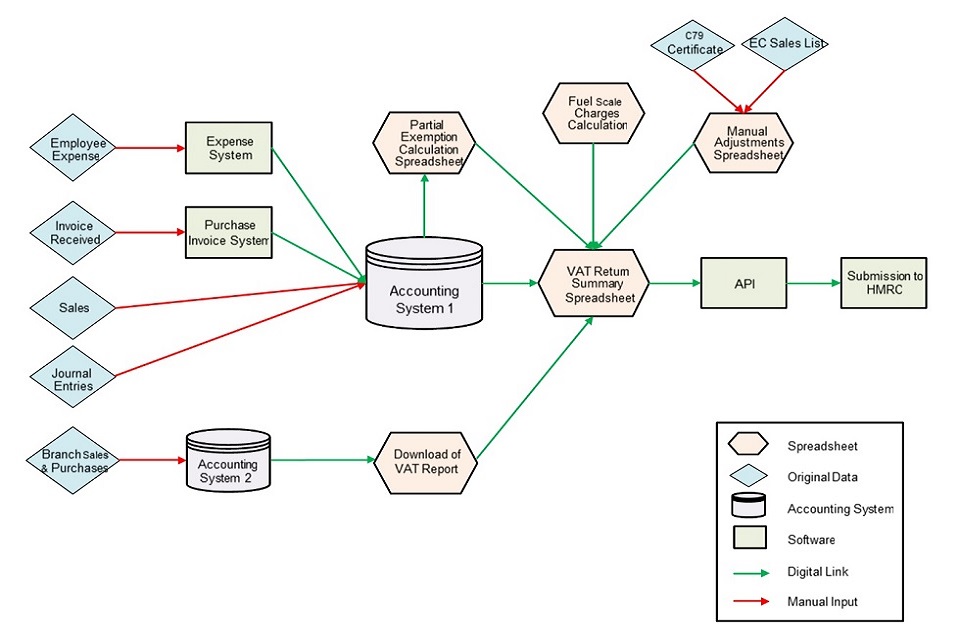

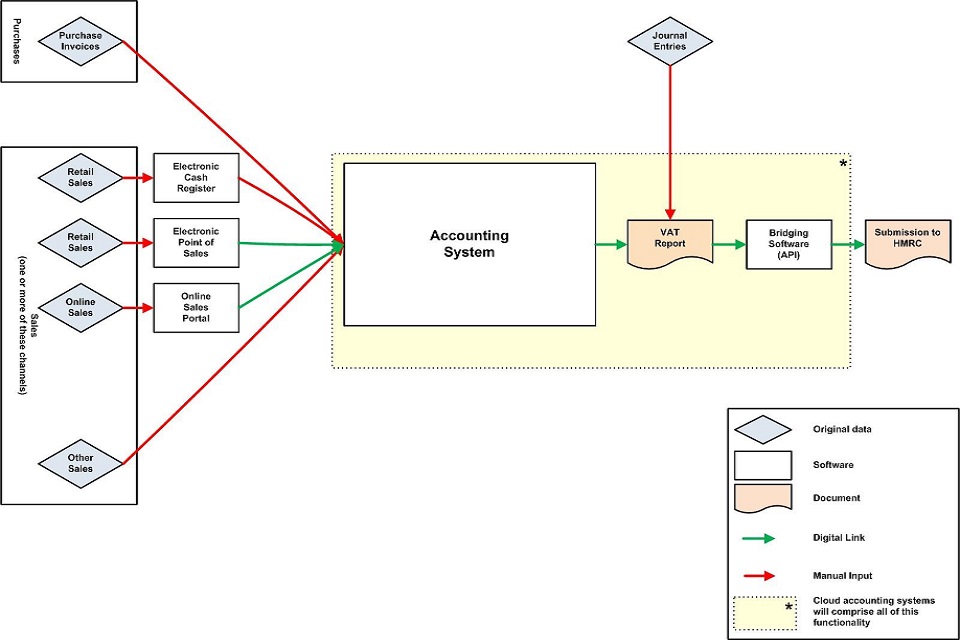

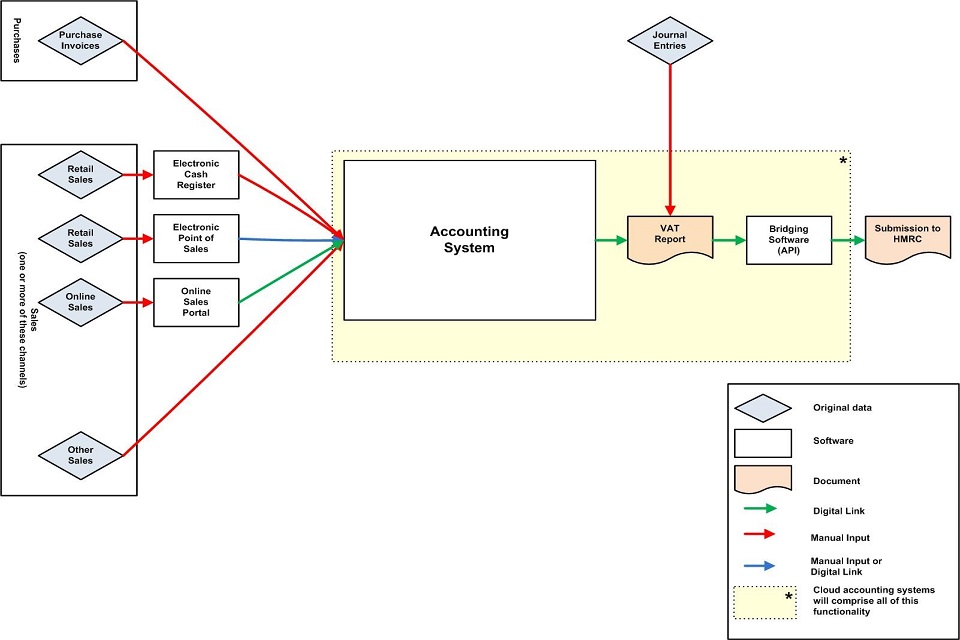

- submit details of the systems that are unable to be digitally linked (provide a current map of your existing VAT systems, highlighting the exact areas that cannot be digitally linked)

- provide a clear explanation and timetable for when and how you will become fully MTD compliant (ordinarily no later than one year from the end of their soft landing period)

- state the controls you will put in place to ensure any manually transferred data is moved accurately and without error

What is unachievable and not reasonable

What is unachievable and not reasonable will depend on the individual circumstances for example where a:

- component part of the businesses IT system is not capable of importing and exporting data from another part of the IT system and it is not possible to update or replace that non-compliant component (or supersede that part of the system) by the end of the soft landing period

- business is in the process of updating or replacing its IT system and the planned implementation date for the new IT system is not before the end of the soft landing period

This is not an exhaustive list.

Cost alone is not sufficient reason to issue a specific direction. You are expected to make every effort to comply with the MTD requirements by the end of the soft landing period. A specific direction in relation to digital links is only intended to be issued in exceptional circumstances.

How to apply

You will need to:

- understand what the obligations are for Making Tax Digital; this may mean consulting HMRC guidance (VAT Notice 700/22) or your Agent (if you have one)

- email mtdspecificdirections@hmrc.gov.uk to request an application form,with your business name and VAT Registration number – businesses with an allocated Customer Compliance Manager (CCM) should request a form directly from their CCM

- work with your CCM if you have one (for Large Business customers and relevant Mid-Size, Public Bodies customers) to submit all the required information with your application.

- be aware of any issues that could delay an application, such as, internal sign-off, delays in obtaining system process maps – see examples of system process maps

A specific officer will be allocated to review the application provided that it has been completed in full.

Once the above information has been submitted HMRC will:

- formally review the information provided

- discuss the information with respective Customer Compliance Managers, where relevant

- ask for further information or evidence if necessary

- issue the direction as appropriate

Where it is not considered appropriate to issue the specific direction, HMRC will let you know the reasons for their decision.

All applications will be considered on a case-by-case basis.

Businesses should ensure they progress their plans to become digitally linked while waiting for a formal response from HMRC.

Examples of system process maps

Example 1

Example 2

Example 3