Business rates relief statistics for England 2018-19

MHCLG has published statistics on national non-domestic rates collected by local authorities in England the financial year 2018 to 2019.

Total relief provided to charitable occupations (that is both mandatory and discretionary relief) amounted to approximately £2 billion in respect of 2018-19. This is approximately 44% of all reliefs given in value terms.

The statistics indicate that if there were no charity reliefs the cost to the sector would be approximately £2.42bn. Once discretionary and mandatory relief was applied charities still paid over £400m in business rates in 2018-19.

The statistics indicate that if there were no charity reliefs the cost to the sector would be approximately £2.42bn. Once discretionary and mandatory relief was applied charities still paid over £400m in business rates in 2018-19.

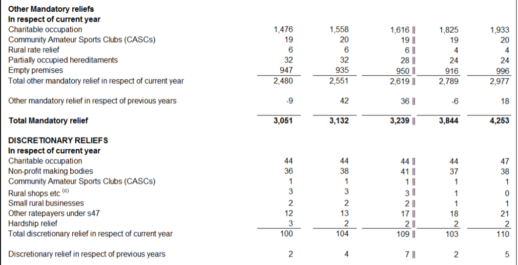

Although business rates mandatory and discretionary rate relief for charities increased compared to 2017-18 (by £108m and £3m respectively) it is not clear whether this is because more charities claimed relief or business rates bills were increased – the latter may be more likely.

In October, it was reported that charity business rates relief (mandatory and discretionary) in Scotland was £232.4m in the same period. The UK Charity statistics estimated that UK wide business rates relief was £2.2bn.

Other points to note include:

- Local authorities reported that the non-domestic rating income for 2018-19 was £25 billion. This amount is what authorities collected after all reliefs, accounting adjustments and sums retained outside the rates retention scheme are taken into consideration.

- Local authorities reported that they granted a total of £4.5 billion of relief from business rates in 2018-19. Of this £1.3 billion is the net cost of small business rate relief, £3.0 billion is the cost of other mandatory relief, and £0.2 billion is the cost discretionary relief.

- Local authorities reported a net increase in appeals provision of £122 million in 2018-19.