OTS Inheritance Tax Review – second report published

The Office of Tax Simplification (OTS) has responded (see below) to its consultation on inheritance tax review. There was one question that related specifically to charitable giving.

Charitable giving

If a person gives to charity in their will or during their lifetime, this is exempt from IHT. If 10% or more of a person’s net estate is given to charity in their will, IHT may be payable on the whole estate at a lower rate of 36%. There are also complex rules about the incidence of IHT between exempt and non-exempt parts of the residue on death.

18) How well do you think the charitable exemption and the lower rate of tax on death is understood by advisers or the public? Please tell us about any areas of complexity in the application of this rate, or the charitable exemption, along with any suggested improvements.

CTG submitted a short response to the consultation, highlighting the value of the relief as an option for donors and calling for improved communications about the relief to help increase take-up.

The OTS published its first report into its review into IHT which focuses mainly on administrative issues. There is reference to the charity exemption, including practical concerns about its operation. The OTS has confirmed that it will return to this and other complex areas in a second report to be published in Spring 2019, with the aim of investigating the ongoing debate about how these more complex aspects of the tax could be simplified.

The second report has also been published and contains 11 recommendations to deliver a more coherent and understandable structure of the tax. Four main areas are grouped as packages, where some elements have an Exchequer cost and others raise money. They are: the taxation of lifetime gifts; looking at who pays tax where lifetime gifts are taxable; simpler exemptions for lifetime gifts; and a review of business exemptions to ensure they are focused on the policy goals and are consistent across different taxes.

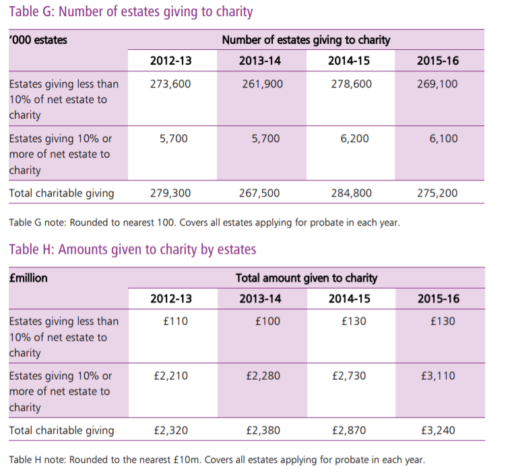

In respect of charities, the OTS has heard that this recently introduced relief is not well understood and that it is complicated to establish whether the reduced rate applies. HMRC data indicates that it has not yet been widely taken up. However, this relief will take time to fully embed itself because, unless someone is already planning to leave a large amount to charity, it requires a change to their will. For this reason, no recommendations have been made on the 36% rate.

Also

“The policy aim of the reduced rate is stated to be to encourage people to leave 10% of their estate to charity. It is currently only a very low percentage of estates in which such a large proportion of assets are left to charitable causes. The OTS heard that legacy giving is a vital resource which funds the work of many charities, and that most of this resource comes from the small number of estates who gift more than 10% of their net assets. It is perhaps unsurprising that there is no data that can show whether the introduction of the reduced rate has yet had any material impact on the level of legacy giving to charity. An individual would need to consider the relief at the time they are making or revising their will. There will then generally be a period of some years until the death of the individual, and a further period of six months by which any Inheritance Tax must be paid. The OTS accordingly considers that it is still very early days for the reduced rate. More time is needed before it will be possible to evaluate its effectiveness and therefore no recommendations on it are made in this report.”

The report notes that

“Data shows 2.1% of all estates applying for probate gift more than 10% of their net assets to charity on average and this relatively small number of estates are responsible for most legacy gifts”